Print

Print

There are three mechanisms available under the EP&A Act to allow councils to require contributions towards local infrastructure. These are:

- section 7.11 contributions

- section 7.12 levies

- planning agreements.

Councils must decide the most appropriate mechanism for their circumstances as they are ultimately responsible for the delivery of local infrastructure in their local government area. This module provides guidance on when to use each mechanism, as well as other funding sources councils should consider when planning for and providing infrastructure.

Legislative requirements

There is no legislative requirement to use one mechanism over another – this is at the discretion of councils. However, there are requirements around how the mechanisms can be used in combination.

| Legislative requirements | Reference |

|---|---|

|

If a section 7.11 plan and a section 7.12 plan apply to the same piece of land, a council cannot charge both types of contributions. |

7.18 (2) EP&A Act |

|

A section 7.12 condition and section 7.11 condition cannot be imposed on the same development consent. |

7.12 (2) EP&A Act |

|

Planning agreements can be used in addition to or instead of section 7.11 contributions or 7.12 levies. They are a separate mechanism that does not need to be tied to a local contributions plan. |

7.4 EP&A Act |

Councils should consider the circumstances of their local government area, the nature of development, type and amount of infrastructure needed and the resources available for managing the contributions before deciding which mechanism to use.

- Councils can use a combination of mechanisms in their local government area and this can change over time as the development profile of the area changes.

- Not all types of infrastructure can be funded through every mechanism. Councils should consider the infrastructure needed when choosing the appropriate mechanism.

- Some mechanisms can only fund part of the infrastructure costs, and councils will need to use a mix of funding sources.

- Councils should also consider the staff, resources and time they have available to manage the contributions process.

Infrastructure contributions can only be required through the contributions system

The mechanisms available under Part 7 of the EP&A Act are the appropriate way for councils to require contributions for local infrastructure. Councils should not pursue contributions schemes through development control plans or local environmental plans (other than affordable housing contributions). This ensures the infrastructure contributions system is transparent and consistent.

Section 7.11 contributions are usually most appropriate in greenfield or significant infill areas where the rate and type of development are more predictable and there will be a significant increase in demand for infrastructure created by development. They are also more appropriate where the high cost of infrastructure justifies the significant resources needed for section 7.11 contributions planning and the ongoing management of these funds.

This type of plan requires the council to demonstrate the nexus between the development and the demand for infrastructure. Councils must apportion costs so that the development is only paying for the demand it creates. If the apportionment isn’t 100% attributed to the new development, councils will need to fund the part of the cost of infrastructure that benefit existing residents from other funding sources, such as rate revenue or grants. However, a section 7.11 plan can create more certainty around infrastructure funding because, after taking into account apportionment, this type of plan can fund the full cost of the infrastructure.

When to use section 7.12 levies

Section 7.12 levies are a flexible mechanism that can be used in a broad range of situations. They generally have lower rates of contributions, but this is offset by greater flexibility in expenditure and administrative efficiency.

Section 7.12 plans are useful in situations where it can be difficult to determine the types of future development and activities, the rate at which development will occur, and where it will occur, making detailed infrastructure contributions planning difficult. For example, in areas experiencing low or unpredictable rates of development, or areas with a significant commercial or industrial development component.

These plans have less certainty than section 7.11 plans because the contribution is based on a set percentage charge on the cost of development, rather than being based on the cost of infrastructure as section 7.11 plans are. They are not necessarily intended to recover the full cost of the infrastructure needed in an area, but act as a simple mechanism to collect contributions towards this infrastructure.

When to use planning agreements

Councils can use planning agreements in a wide variety of circumstances, set out in section 7.4(2) of the EP&A Act. Planning agreements tend to be more successful where there is a large landowner who wants to coordinate and deliver infrastructure at the same time as the development. Agreements can offer different and better outcomes through efficiencies in the development and infrastructure construction process or through innovation.

However, councils must consider whether the outcomes of a planning agreement are worth the effort and administration required to negotiate and implement an agreement.

Comparing the different mechanisms

| Section 7.11 contributions | Section 7.12 levies | Planning agreements | |

|---|---|---|---|

| Mechanism objective |

Aim to be certain and transparent Cost reflective charge that can act as a price signal for the cost of development Rigorous process to ensure plan is reasonable and accurately reflects the cost of providing infrastructure Application of reasonableness, nexus and apportionment |

Aim to be efficient, consistent and simple Low and simple fixed rate Does not need to establish nexus and apportionment Should have a general relationship between infrastructure and demand |

Aim to be flexible and efficient Negotiated outcome that is voluntary for both parties Facilitates direct delivery, out of sequence development and innovation Should not be wholly unrelated to development and demand for infrastructure |

| Development pattern |

Greenfield or significant infill areas Areas where the rate and type of development are more predictable and there will be a significant increase in demand for infrastructure created by the development |

Infill areas where there are lower rates of development or the scale and patterns of development are uncertain Established urban areas, where development is mainly ‘infill’ development and is also sporadic Rural and regional areas, where there are slow rates of development or development is sporadic Commercial and industrial areas, where direct demand for public infrastructure is difficult to establish for individual development |

Major growth or development occurring in a distinct area Specific infrastructure is required to facilitate development and a developer offers to deliver it A proposed development has not been anticipated by the council and works and facilities to cater for this development have not been identified in a contributions plan |

| Resource requirements | Time and resource intensive to prepare, implement and administer | Simple and administratively efficient to prepare, implement and administer | Time and resource intensive to prepare, requires legal advice, requires a developer to initiate the negotiation and support from all parties affected by the agreement |

| Land ownership pattern | Fragmented land ownership | Fragmented land ownership | Land owned by a single or very few landowners or a consortium |

| Infrastructure need |

Appropriate for areas:

|

Appropriate in areas where:

|

A negotiated outcome appropriate where:

|

| What infrastructure can be included |

Can only include capital costs for local infrastructure If the plan charges a contribution over a certain threshold, it can only include infrastructure on the essential works list In some limited instances can include ongoing cost for roads to service heavy vehicular traffic from development such as mining and extractive industries |

Can only include capital costs for local infrastructure |

Can include a wider range of infrastructure types and can include funding for recurrent costs Appropriate where a developer is seeking to provide infrastructure that is beyond the scope of what is permitted in a section 7.11 or section 7.12 plan |

| IPART review | If the plan charges a contribution over a certain threshold for residential development, it must be reviewed by IPART | No IPART review | No IPART review |

| Opportunity for appeal | Can be challenged on the ground that it is unreasonable and can be appealed on the basis that the EP&A Act or Regulation have not been complied with (section 7.13 (3) EP&A Act) | Can be appealed if the legislation has not been complied with in the preparation of the plan (section 7.20(3) EP&A Act), but not on the grounds of reasonableness (section 7.12(4) EP&A Act) | Can only be appealed if there a failure to follow procedures required in the EP&A Act or Regulation (per section 9.45 EP&A Act) |

Infrastructure should be funded from multiple sources

Contributions plans generally only fund a proportion of the full cost of the infrastructure provided by councils, for example because some of the cost may have been apportioned to existing development. Councils will need other funding sources for the portion of infrastructure that will service existing demand and the cost of running and maintaining the infrastructure.

Different sources can be used in combination. Councils should consider sources of funding such as rates, federal and state grants or subsidies. It may also be appropriate to have user charges for some local infrastructure.

Councils must ensure that they do not ‘double-dip’ when using multiple sources of funds. Double-dipping is where the same component of an item is funded twice, for example through the collection of contributions and through a grant.

General revenue: For most contribution plans, a proportion of the cost of infrastructure must be funded from general revenue. This includes any of the costs in a contributions plan that are apportioned to the existing community. General revenue comes from rates and other fees and charges collected by councils.

Special rate variations: Councils can apply to the Independent Pricing and Regulatory Tribunal (IPART) for a special rates variation, this is a special variation to general income above the rate peg amount. IPART considers applications against the guidelines set by the NSW Office of Local Government.

Conditions of development consent: In some circumstances, councils can require infrastructure to be provided through conditions of development consent instead of through a contributions plan. Section 4.17(1)(f) of the EP&A Act allows consent authorities to impose a condition of consent that require developers to carry out works that relate to any matters of consideration outlined in section 4.15(1) of the EP&A Act.

When determining if works should be required as a condition of consent, councils should consider whether the works:

- are required as a direct result of a single development

- are not covered by an existing contributions plan

- can be reasonably provided by the developer as part of their development

- will be undertaken by the developer.

Some examples include traffic management at the entry to the development, internal drainage works or footpaths. For mining and energy developments, specific impacts are those related directly and exclusively to the development, such as roads, noise, dust or visual amenity. These should be considered early in the development assessment process and mitigated through conditions of consent where appropriate.

Procedure and process

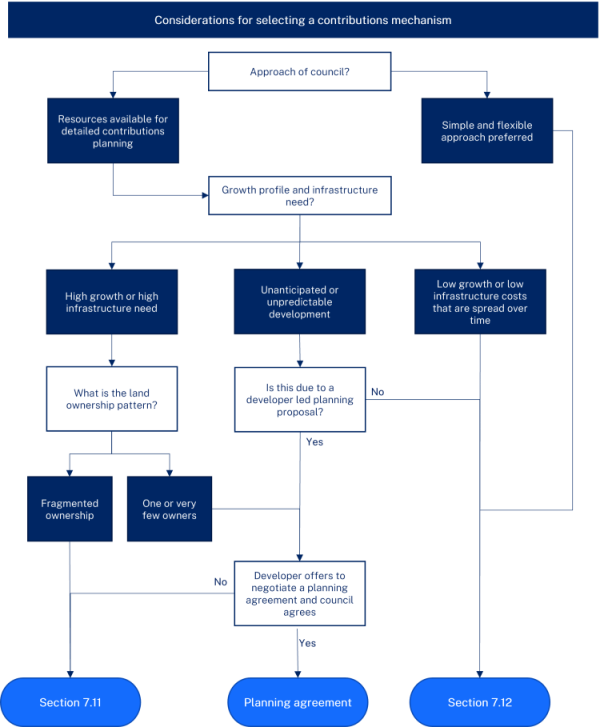

This process map can assist councils to select an appropriate mechanism to fund their local infrastructure.

Although all three mechanisms are shown within the same process map, this is unlikely to be the case in practice. Planning agreements are a complementary mechanism to contributions plans and are often considered at the level of an individual development, while contributions plans are considered early and at a catchment or local government area wide level.

This simplified map aims to demonstrate the key differences.

Examples

Council with multiple different development sites

A council with areas of intensive greenfield development on rural fringes, as well as low level infill development occurring throughout their local government area might decide to use all three mechanisms. For example, this council might implement:

- A section 7.12 plan to apply across the entire local government area to ensure that the ongoing infill development contributes to the infrastructure needed to support this growth – each instance of this type of development has a low impact, but over time it can represent a significant cumulative increase in demand for infrastructure.

- A section 7.11 plan for specific new growth precincts with high infrastructure need. These plans reflect the actual cost of providing the infrastructure in these areas and increase certainty of it being delivered.

- A planning agreements policy outlining the circumstances where council would consider negotiating planning agreements, such as:

- an unexpected development or developer led rezoning is proposed that has strategic merit but hasn’t been considered in the infrastructure planning

- a developer offers an innovative way of providing the infrastructure.

Council with no defined development sites

Councils with low levels of dispersed development might implement a local government area wide section 7.12 plan. This is a simple and administratively efficient approach, which allows them to capture infrastructure contributions without a significant staffing requirement. These funds can be used over time to invest in infrastructure to benefit these communities.

Infill council with major redevelopment sites or significant dispersed growth

A council with predominantly infill development might decide to use a combination of mechanisms, including:

- A section 7.12 plan to apply across the entire local government area to ensure that the ongoing infill development contributes to the infrastructure needed to support this growth – each instance of this type of development has a low impact, but over time it can represent a significant cumulative increase in demand for infrastructure.

- A specific section 7.11 plan for an identified precinct that the council anticipates will be redeveloped soon – for example, a precinct around a train station that will be changing from free-standing houses to high rise development.